No matter how long you’ve been in business, getting invoices processed on time is a perennial problem for WordPress developers. Spending time chasing down unpaid invoices and making sure every payment gets handled smoothly can end up chewing through a lot of your time.

A lot of developers are worried they’re going to offend their clients by having strict payment terms or consistently following up with their invoices. Running a small business can be stressful after all, and we all know how important it is to ensure we’re in good standing with our customers.

So, the question is: is it possible to have clients happily pay your invoices on time, all the time?

In this article, we’re going to examine ten different tips you can implement to help get your invoices paid faster, without jeopardising the client relationships you’ve taken so long to build.

Let’s get cracking!

- 1 1. Be Polite

- 2 2. Customize Each Invoice for the Respective Client

- 3 3. Keep the Payment Terms Simple

- 4 4. Charge an Interest Fee for Late Payments

- 5 5. Offer Incentives for Faster Payment

- 6 6. Have a Process for Following Up

- 7 7. Ensure Your Invoices Leave No Room for Debate

- 8 8. Make Paying Easy

- 9 9. Set up Recurring Invoices

- 10 10. Ask for Upfront Payments

- 11 Conclusion

1. Be Polite

Civility costs nothing and being polite goes a long way. We spend so much of our days staring into a computer screen that it’s all too easy to forget there’s a human on the other side of most transactions. When you’re sending invoices, remember that you’re dealing with a real-life client, not an ATM machine.

It’s important to respect your clients and show you actually value their business. Getting this right can be as simple as choosing the right words. The online accounting company Freshbooks recently conducted a study to determine which invoice factors will help get you paid faster.

They found that phrases as simple as “please pay your invoice within” or “thank you for your business” can increase the likelihood of being paid quickly by 5%. That’s a small number at first glance, but it adds up to a lot of money you’ll see sooner over time.

Being polite doesn’t take a lot of extra time, improves your customer relationships, and increases the chances of your invoices getting paid on time. What’s not to like?

2. Customize Each Invoice for the Respective Client

No one likes receiving stock messages or canned responses. It’s the type of impersonal approach that naturally turns people off.

This may have been par for the course decades ago, but societal preferences have changed and the technology is there to make customization and individualization easier than ever before.

Add Personal Details

The first thing to double-check is whether you know who you’re actually supposed to send the invoice to. This sounds blindingly obvious, but you need to make sure you’re sending the invoice to the person who’s actually going to take care of paying you.

You may well have already suffered the consequences of getting this wrong in the past. Painful games of email/phone tag, and prolonged delays in the money actually hitting your account, are the inevitable result. Get the basic details right from the beginning.

Once you’re sure you’re dealing with the right person, take appropriate steps to customize the actual invoice and accompanying cover letter or email.

Include the Necessary Payment Processing Information

Whenever you hire a new client, make sure you ask invoice specifics as soon as possible. For instance, do you need to include a purchase order number? Can you send an invoice via PayPal? Does the invoice need a very specific type of service or line item breakdown?

The more details you can get about the specific invoice requirements, the better. Almost every company processes their invoices a little differently, so be sure to tailor your invoices accordingly. In many cases, all it takes is the omission of one tiny detail and you’re right back to square one in terms of getting your invoice actually processed.

Sure, doing this work up-front takes more time initially, but it will pay off big time down the road.

3. Keep the Payment Terms Simple

Your invoices should be as simple as possible. A lot of people use complex payment terms in a vain attempt to sound more official or professional. Don’t make this mistake.

Set a specific timeline for when you expect your invoice to be paid and make sure this is cleared with the client in advance. There is no point in dramatically adding “this payment is due within five days of the invoice issue date” if your client is on a 60-day billing cycle.

Hammer out terms in advance, make sure they are expressed clearly on your invoices, and set a personal reminder to follow up on the due date if nothing has been received.

4. Charge an Interest Fee for Late Payments

Interest fees can be a great way to speed up payment processing. Face it, no one likes to pay extra when it could have been avoided in the first place. Late fees also help to create a sense of urgency on behalf of the client.

When implementing a late payment fee, make sure the terms of the agreement are completely laid out before you even begin work. This simply has to be in a contract and signed by both parties to have any chance of enforcing it. Try tacking it on after the fact and you will be whistling in the wind, and almost certainly antagonizing a possibly already recalcitrant client.

Make sure the interest fee terms are precisely summarized on both the contract and the invoice so things are crystal clear for the client. Simple phrasing like “a 1.5% interest fee will be applied to payments that are 30 days past due”, will do the trick.

The actual dollar amounts involved here may often be negligible, but it can be a very effective tactic for ensuring prompt payment.

5. Offer Incentives for Faster Payment

Sticks are often best accompanied by carrots. In addition to using negative motivation in the form of late payment fees, you can also employ positive motivation by offering clients incentives for paying quickly.

These can be structured in many different ways. Standard options include the following:

- Offering a discount for customers who pay within one week.

- Offering a gift certificate for a partner site’s products or services that might appeal to your clients. This can also be a nice way of initiating co-operation agreements with partners.

- Offering a store credit for your online store.

- Offering free promotional merchandise.

- Offering a percentage discount on future work.

Think of incentives as ways to thank your current customers for putting you first. It can be a very powerful tactic for building positive relationships with your clients over time and making sure you’re consistently promptly paid.

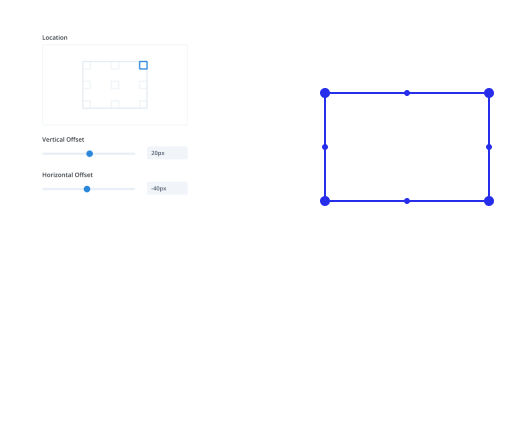

6. Have a Process for Following Up

This one is something freelancers often find particularly hard to do. It’s perfectly okay to follow-up with clients who have outstanding invoices. You should never feel bad or awkward about doing this. You’ve done the work, you’re entitled to get paid on time.

Many freelancers get nervous about following up for fear of antagonizing or offending their clients, but it’s something that simply has to be done. If you consistently follow up over time, you’ll find people starting to pay you faster and not letting things slide. The ones who repeatedly don’t respond are not the sort of clients you should be working with anyway.

Follow-up emails don’t have to be a source of drama or unpleasantness. A simple reminder is all that’s initially required.

Even something as simple as the email above will gently nudge your clients towards the payment button.

One way to avoid forgetting to follow up with late payments is to schedule automatic reminders with your clients. Freshbooks has automatic follow-up built into their invoicing software, as do most similar service providers. If you want to handle things more informally, or on a case-by-case basis, a simple solution like Boomerang is more than enough to get the job done.

7. Ensure Your Invoices Leave No Room for Debate

Your invoice needs to have an in-depth breakdown of the work performed. If you’re sending out vague invoices, it leaves a door open for client confusion and eventual late payment.

This is a question of balance. You don’t want to overload your client with too many project details, but you do want it to be instantly obvious to them what they’re paying for.

As in our second point above, specifying invoicing requirements in advance goes a long way here, but there is also a heavy onus on you to be organized in your own working habits. If you’re billing hourly, for example, make sure you’re effectively tracking your time and have a breakdown of the project hours to hand.

If you’re billing based upon value, make sure the deliverables agreed in your project’s contract are spelled out in very clear terms. Before you send the invoice, ask yourself: does this clearly and succinctly outline the work performed?

At the end of the day, you want your client to quickly glance over the invoice, nod their head appreciatively, and then hotfoot the money to your account. If you’re looking for more info on specific invoicing tactics to make this sequence of events more likely, check out Smashing Magazine’s Invoice like a Pro article. It’s an oldie but a goodie.

8. Make Paying Easy

You’ll want to make it as easy as possible for your clients to pay you. Do you have very strict payment terms, or are you limiting yourself to only accepting one type of funds transfer? You may be making things unnecessarily difficult for your clients.

If you’re really serious about getting paid quickly, ask your clients what method of payment they prefer, rather than trying to force them into one particular method. Some companies will prefer paying with credit card, some will want you to use PayPal, others may be more comfortable with direct bank transfers.

If possible, you should support more than one payment option. Bank transfers are always an option seeing as you have a bank account to begin with. Make sure you’re including the correct details for both domestic and international transfers on your invoices.

Setting up a PayPal account kills two birds with one stone. You can receive PayPal transfers and also accept credit card payments via that route. A world of further options such as Skrill, Venmo, and (for the adventurous) Bitcoin are available, but a bank account and PayPal combo covers most of the basics.

9. Set up Recurring Invoices

Reliable recurring income is the holy grail of most businesses, online or otherwise. Ask if yourself if there is some aspect of your service where this type of arrangement might make sense. If so, go for it.

Recurring payments are a godsend in terms of accurately predicting monthly cash flow. Having a proportion of your income boxed off is particularly useful for freelancers who are often dealing with a generally unpredictable feast or famine environment.

One way of integrating this option that makes sense for a lot of WordPress developers is setting up a monthly retainer. This could cover certain aspects of your services such as site maintenance or a fixed amount of monthly development work while leaving you free to charge for specific projects separately.

Recurring payments are useful from the client side too. They know exactly what they’re getting and when.

10. Ask for Upfront Payments

If you regularly bring new clients on board, having a procedure for upfront payments makes a lot of sense. This helps build trust for both parties, weeds out problematic clients in advance, and gives you ample motivation for cracking on with your best work. Plus, it does wonders for short-term cash flow.

You don’t have to ask for the entire payment upfront – even a small percentage is enough to do the trick. One standard option is to simply request one-third of the project fee either in advance or on completion of the first significant milestone.

Another approach which makes sense in certain circumstances, is to require a small, non-refundable deposit to cover your initial work on project and client setup and needs assessment.

You can also, of course, take this approach with repeat clients on one-off projects, but it lends itself particularly well to first-time encounters.

Conclusion

None of the tips we’ve covered are particularly hard to set up on a practical level, but you might find yourself having to get over a little bit of internal resistance with some of them.

Bite the bullet and just do it because any one of the tips will be enough to speed up your payments. Implement them all and you’ll be seeing stellar results in a hurry.

Let’s review the basics one more time:

- Be polite and professional.

- Offer positive and negative incentives to clients.

- Keep things simple and hit all invoicing requirements right first time.

- Offer multiple payment options and consider recurring billing.

- Never be afraid to follow up.

Are there any tips we missed that have helped you get paid on time in the past? If so, please share your favorite tips and tricks in the comments.

Article thumbnail image by venimo / shutterstock.com.

I’ve looked at a number of solutions for accepting payment. I wanted something that would allow me to offer many kinds of payment methods and recover any fees from those methods. I really liked what I saw with Stripe. But they said they couldn’t handle the large transactions I was needing. My cruises are in the tens of thousands. I later found PayStand. I like that it allowed the customer to choose which payment method would save them the most money just by clicking on the buttons on the top. http://www.paystand.com/accept-credit-cards The ability to pass on any fees that I get from payment processing is a major plus. I’m not going to pay 3.0% just so a credit card processing computer can flip a switch. Banks need to know their days are numbered.

So if you want to pay $60,000 on your credit card to book a cruise then go ahead. I’m charging you $1,500 (2.5%) for the processing. You would save a ton of money by using any other form of payment. What about a old fashion paper check? Yep! I can even accept paper checks by taking a picture of the check with the smartphone. I can even link it to invoicing http://www.paystand.com/lawfirms

So how do they compare to other payment systems? Here is their data sheet. I can even link it to invoicing http://www.paystand.com/lawfirms

If you do very little business, the $99 monthly fee might be a bit much. But if you are doing thousands and hate paying the credit card fees then this might be your solution.

I ran into the same PayPal problems as PseudoGeek and moved to Stripe. Paired with Freshbooks I’ve been very happy.

I find that setting the first “late” notice to be emailed 5 days before the due date works well as a reminder that the client has an invoice due. 5 days gives them enough time to mail a check, plus the URL is in the email if they want to pay online via credit card.

Oh, and setting a recurring invoice at the end of the month that automatically adds any unbilled time keeps me from forgetting to charge them for hours worked and logged.

Anytime I send a document to a client, be it an image file, proof, or invoice, I begin with “Please confirm receipt by reply email.” That acknowledgement goes a long way towards getting the clients attention and pushing the process forward.

I highly recommend “10. Ask for Upfront Payments” whenever applicable. This cuts your invoicing and bill collecting time down significantly leaving more time for developing.

I recommend Zoho Subscriptions.

I just want to thank you guys.

Another good subject in the newsletter, thnks ! 🙂

I disagree with PayPal being easy for the client – especially when signing up for recurring hosting payments, I’ve had little success keeping customers on PayPal. It is extremely hard-core about cancelling their accounts if their cards are not kept up to date. No way to adjust things; it is going to cancel the account in a few days.

Stripe is a little more involved for us to set up, but once you have your secure server certificate, a program called “WP Full Stripe” lets you create the recurring payment plans and forms very easily. It costs about $35 from Code Canyon and is worth every penny. Now all the customers who fled PayPal, forcing me to do the arduous paper invoicing, are getting on Stripe payment plans. This frees me to do web design instead of billing. With Stripe’s subscriptions, you can customize how long Stripe waits before cancelling their account, making it much more user-friendly. And, there is no complicated “joining” process like PayPal – the customer doesn’t become a member.

I wouldn’t recommend PayPal to your dog.

My opinion is payments are safe when the developer manages to build a strong relationship with his partner, aka personal relationship when they trust each other and know it’s their mutual benefit to have a smooth business together. I find it interesting to offer an incentive for prompt payment.