Conducting an accurate company valuation is not as simple as it sounds. How much your business is worth depends on a myriad of factors, each of which speaks in some way to your company’s potential for success.

In this article, we’ll break down the five primary factors that can influence your company’s worth. We’ll talk about how public and private valuations work and introduce you to a couple of tools you can use to make back-of-the-napkin estimates regarding your own business.

Let’s dive in!

Why Is It Important to Know How Much Your Company Is Worth?

Your company’s worth isn’t as useful as money in the bank, but it’s the next best thing. While it’s clearly important to know the dollar amount associated with your business’ value if you want to sell it, having this number on hand is also useful if you want to:

- Apply for a business loan. Businesses with high valuations often represent smaller risks. This can result in lower interest rates and more capital to expand your brand.

- Attract investors. Investors often see companies with high valuations as less risky. Once again, this may provide you with more funds to develop new products, expand production, or otherwise grow your business.

It’s important to understand that the value of a business doesn’t come down to just its profits. In practice, there are a lot of criteria that can affect the worth of your company in the eyes of banks, investors, and buyers. Understanding what those criteria are is essential to growing your business.

How Much Is Your Company Worth? (5 Factors that Determine Its Value)

The first thing many investors look at when it comes to determining if a business is a smart risk is its earnings, for obvious reasons. However, there are several other elements that come into play as well. Here are the top five factors that influence your company valuation.

1. Profitability

A business that makes a lot of money should be worth a lot of money. To illustrate how profitability impacts a company’s worth, let’s focus on a real-life example: Airbnb.

Before the COVID-19 pandemic, Airbnb was planning an Initial Public Offering (IPO) for 2020. This is when a private company offers its first shares of stock to the public. The higher your company’s worth, the more money you should be able to raise with an IPO.

In 2019, Airbnb’s revenue was $4.8 billion. At the start of the year, the company had an internal valuation of $26 billion. During its last round of funding, it was privately valued at $31 billion, which enabled it to raise a cool billion to re-invest in the business.

However, once health advisories started to affect the travel industry, Airbnb’s valuation started to fall. The company’s revenue is projected to decrease by 54 percent in 2020. That drop in profitability led to a sharp decline in its value, which is now about $18 billion.

Fortunately for Airbnb, profitability is just one piece of the puzzle. That’s why a company whose entire business model was shaken up nearly overnight is still worth billions.

While how much your company earns now is important, investors also want to feel reassured that you can continue to generate revenue for years to come. That’s why they consider your market share, or the percentage of total industry sales your business accounts for.

Since Airbnb is available in 220 countries, it has different market shares in each region. In the US alone, it accounts for about 5.5 percent of the travel lodgings market. That number might not seem all that impressive, but the US tourism and travel industry alone generated about $1.1 trillion during 2019.

As a business, the higher your market share, the more favorable your valuation should be. However, investors also look at another number, which is your growth rate. For Airbnb, that metric is influenced by several factors, such as:

- The size of the platform’s user base

- How many hosts list their homes

- Booking rates

- Total revenue

For your company to continue earning money, all the other aspects we mentioned should grow alongside revenue. Airbnb’s revenue grew by 40 percent from 2017 to 2018. By the first quarter of 2019, it recorded a growth of 31 percent from the same period in 2018.

Keep in mind, these are the types of numbers often seen with tech startups. During that massive growth spurt, Airbnb retained sky-high valuations over the course of 2018 (an estimated $38 billion) and into 2019.

3. Future Growth Potential

Every company thinks it can take over its market. However, investors need to look even beyond growth rate and market share to determine if a business can really continue to expand.

This factor can be difficult to pin down, as the aspects that influence growth potential vary between industries and even from company to company. With Airbnb, there are several elements that play roles in how it’s expected to perform down the line. For instance:

- Past growth statistics suggest Airbnb’s user base will continue to expand.

- Internal projections say the company’s revenue will be down by about 54 percent in 2020.

- Airbnb is in a coveted position as one of the most popular travel platforms in the world.

- The company is in a unique niche.

The fact that Airbnb satisfies a popular demand (short term vacation rentals in a home-like environment) that few other businesses can meet is a strong indicator the company will continue to grow in the future.

With future growth potential, there’s always a healthy dose of speculation involved. You never know when competitors might arise or if unforeseen circumstances (say, a pandemic) will shake up your business. The best you can do is rely on past indicators and your business sense.

4. Sustainable Competitive Advantage

Every successful business needs a distinct edge. It’s that unique service, feature, brand identity, or product that your company does better than any other. For Apple, its brand is its most crucial asset. Microsoft has its massive market share, which makes Windows the de-facto Operating System (OS) for most of the world.

With Airbnb, its decentralized host system is what makes it unique. A regular hotel chain can just as easily offer lodgings through an app or website. In many cases, the booking process is even easier than using Airbnb, since it’s more standardized.

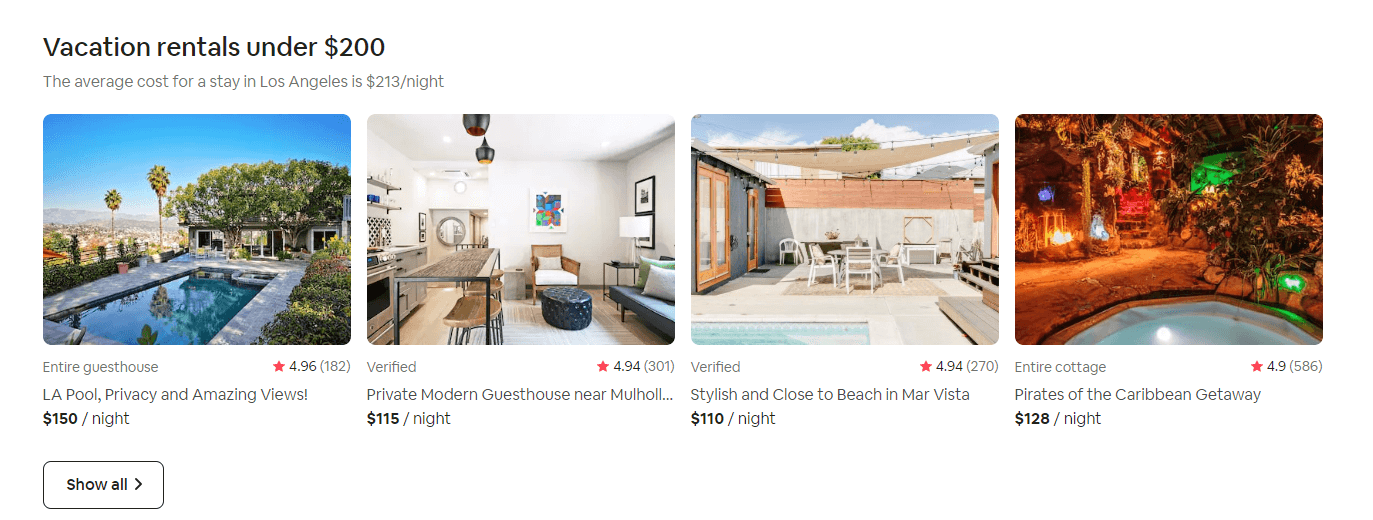

However, hotels can’t match Airbnb’s level of variety. It has about seven million listings all around the world. These rentals range from spartan rooms in shared houses to impressive private mansions:

The diversity of its offerings is Airbnb’s primary competitive advantage. It also doesn’t hurt that many of its listings tend to be cheaper than traditional hotels. It also offers a more comfortable, ‘homey’ environment that is attractive to many travelers.

When trying to determine a company’s value, it’s important to have an idea of whether it can sustain its competitive advantage. For Airbnb, this would mean:

- Retaining or increasing the number of hosts who use the platform

- Increasing its listings in various regions

- Getting more people to use the platform to book lodgings

Comparatively, for a hotel chain to expand its business, it needs to build new rooms and locations. In Airbnb’s case, sustaining its advantage is much less costly.

5. Company Size and Assets

The final criteria you need to consider when valuing a company are its assets and size. As a rule of thumb, big companies with multiple offices and hundreds or thousands of employees are worth more than Small and Medium-sized Businesses (SMBs).

Airbnb has an estimated 14,000 employees in 32 offices around the globe. However, during 2020 it’s had to lay off around 25 percent of its workforce due to how hard the travel industry has been hit by the pandemic. Massive shifts in company size such as these have a significant impact on a business’ worth.

It’s also important to note that a business can have many assets beyond employees or infrastructure. For example, an online store’s domain name is often one of its most important assets, and could significantly influence its company valuation.

How to Calculate Your Business’ Value (For Public and Private Companies)

As you understand by now, there’s nothing simple about calculating the worth of a company. However, if you have a clear grasp of the criteria we’ve discussed, then it shouldn’t be impossible to make a decent estimate. How you go about that process depends on whether you’re looking at a public or private business.

For example, we know that both Apple and Microsoft are worth over one trillion dollars. We can find this information because they’re publically-traded – their finances are wide open and anyone can look them up. With a privately-owned company, you’ll have to do some extra digging.

Estimating the Value of Private Companies

Attempting to value private companies is taxing work. Since they’re not required to disclose numbers, there tends to be a lot of guesswork involved.

In some cases, companies with massive valuations turn out to not be worth half as much. Recent history’s best examples would include WeWork’s fall from a $47 billion dollar valuation to bankruptcy in a matter of weeks.

Assuming that you don’t have access to all the details we discussed in the previous sections, you’ll have to resort to other methods to value a company. These may include:

- Estimating a company’s valuation based on its closest public competitors (known as a comparable company analysis)

- Estimating the revenue of a business by looking at the average rates of similar companies

Notice that both approaches start with the word “estimating”. Without access to hard numbers, the best you can do is make an educated guess. Even if you have a company’s estimated valuation, it might not be all that close to reality.

If you’re trying to determine your own company’s value, then the process is much easier. After all, you should have access to all the data you need. There are even online tools you can use to make quick calculations.

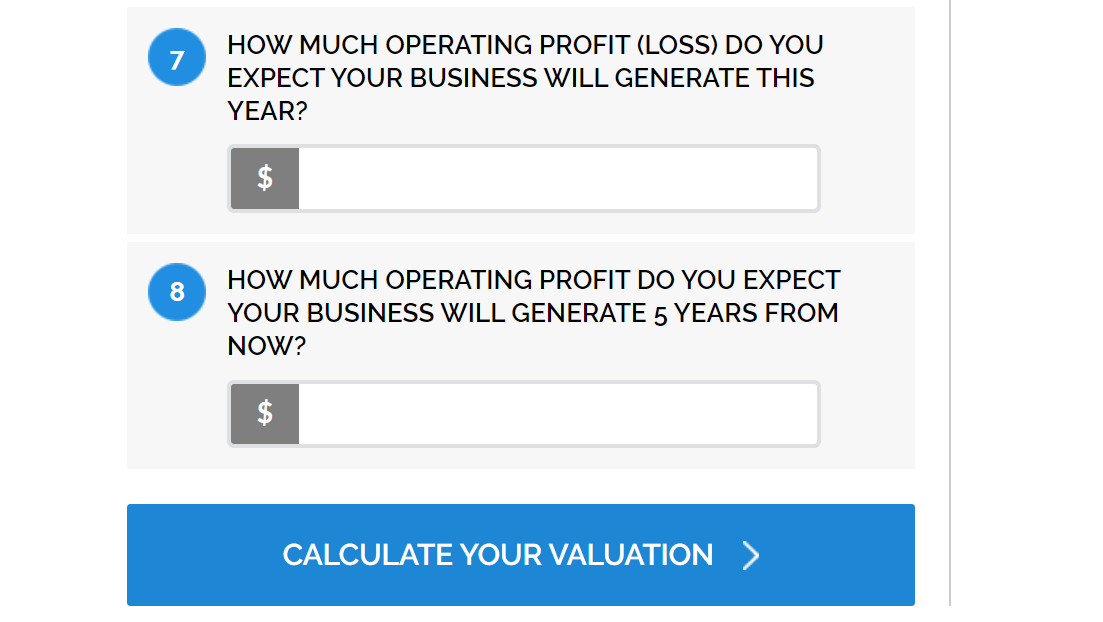

EquityNet’s Startup Valuation Calculator, for example, takes into account your business’ industry, cash and assets, liabilities, and more to help you arrive at an estimate:

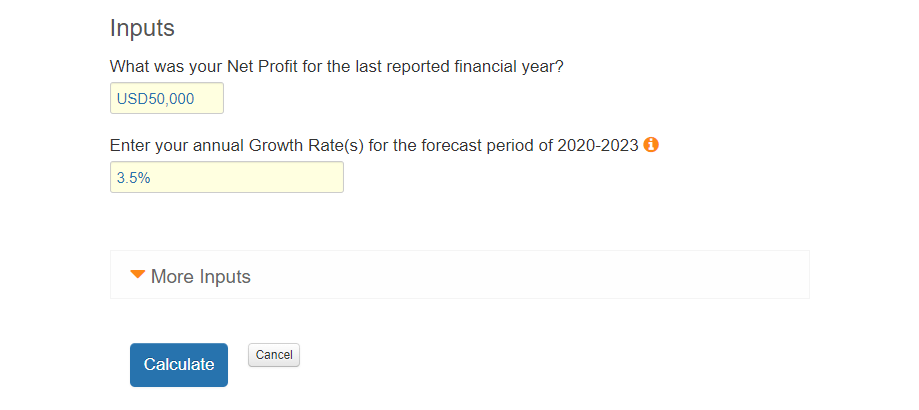

For a rough number, you can also try out ExitAdviser’s Business Valuation tool, which takes your net profit and forecasted growth rate to help you come up with an estimate:

It’s critical you understand that tools like these aren’t in-depth enough to provide an accurate internal valuation. To do that, you need to talk with whoever runs the numbers for your business, as they should have a clearer picture of what it’s worth.

Determining the Value of Public Companies

Estimating the value of a public company isn’t as much an exercise in guesswork as it is a matter of calculations. To arrive at a number, take the whole of the business’ outstanding shares and multiply it by the company’s market price.

All that information should be public since we’re talking about companies that operate on the stock market. For example, we know that as of October 2019, Microsoft had 7,628,805,618 shares outstanding. At a share price of $181.40 as of the moment of this writing, that gives us a valuation of around $1.3 trillion.

Conclusion

Knowing your company’s true worth is critical. At any point, you don’t want to be either under or over-valued. With an accurate valuation, it should be easier to raise or borrow capital for growth. Plus, the more your business is worth, the more you can get for it if you decide to plan an exit strategy.

There are many factors that can affect your company’s valuation, but ultimately, it comes down to five main criteria:

- Profitability

- Growth rate and market share

- Future growth potential

- Sustainable competitive advantage

- Company size and assets

Do you have any questions about how to calculate your company’s worth? Let’s talk about them in the comments section below!

Image by VectorMine / shutterstock.com

Leave A Reply