If you run a business, you want more money coming in than the amount going out – that much is a given. When you work as a contractor, you need to think of yourself as a company if you’re going to scale. That means taking steps to ensure you maintain a positive freelance cash flow.

In this article, we’re going to break down why financial management is a critical skill for freelancers. Then we’ll go over five tips to improve your cash flow and keep your head above water.

Let’s talk about money!

Why Cash Flow Management is a Key Skill for Freelancers

Freelancing isn’t for everyone. When you work for yourself, you have to wear a lot of hats and face many challenges more or less on your own. That includes finding new clients, negotiating rates, and making sure your finances remain healthy.

Financial management is perhaps one of the most difficult aspects of being a freelancer. You can be incredibly talented and charge impressive rates, but you also need to consider when and how you get paid.

Let’s say, for example, you land a big contract for thousands of dollars, but it won’t pay for at least three or four months. If you don’t have a solid cash flow management system in place, you’ll likely struggle to make it through the dry period. Without another source of income, you’ll probably be too stressed to do your best work.

Healthy financial management practices can help you avoid such situations. By planning ahead, you can maintain a positive freelance cash flow throughout the highs and lows of contract work.

5 Freelance Cash Flow Tips

Having a healthy freelance cash flow comes down to ensuring you have money coming in consistently, despite the unpredictable nature of the business. That sounds easy enough, but you’d be surprised at how many people struggle in this area. Here are five tips to help you avoid being one of them.

1. Get Serious About Budgeting

This first tip is the simplest, yet perhaps the most important. As a freelancer, you can’t afford to not have a firm grasp on your finances, so budgeting becomes even more critical than for some other professionals.

The idea behind creating and maintaining a budget is fairly straightforward. All you need to do is:

- Compile a list (or better, a spreadsheet) of your past income and expenses.

- Based on that information, make educated estimates for your future income and expenses.

- Allot future funds towards necessary spending, both for your work and living expenses.

- Track your cash flow so you remain aware of how much money you currently have available, how much you can expect to bring in over the next month, and what upcoming costs you need to cover.

An updated budget should tell you precisely how much money you’re spending each month so you can see where you can cut expenses. It can also help you predict how many projects you need to take to cover rent, health insurance, and other recurring costs.

It’s simple enough to create a budget using basic formulas and a spreadsheet. However, you can also find many templates online to help get you started if you want further guidance.

2. Expand Your Client Base

Unless you have a long-term contract with a client that pays you handsomely, you probably shouldn’t limit yourself to only one project at a time. If a customer flakes on you and they’re your only source of income, you’ll be in the fast lane to a negative freelance cash flow.

The problem is, handling more than one project at a time can be difficult, depending on their complexity. As a freelancer, you’re wholly responsible for managing your own time, so it’s essential to determine how much work you can handle.

To play it safe, you want to have at least two sources of income at any given moment. If you have one client whose projects eat up several hours each day, you can work around this by taking on smaller, fast-payings gigs to pad your savings.

Another mistake many freelancers make is forgetting to secure leads for future work before they’re done with their current projects. This can result in a lot of downtime between clients, leading you to burn through your savings.

You can avoid this by signing up for email lists for sites such as Upwork or Indeed. This will help you source leads efficiently, and avoid forgetting to job hunt even while you’re working on longer projects.

3. Avoid Large Payment Windows When Possible

In an ideal world, clients would always pay you the minute you finished a project. However, if you’ve been freelancing for a while, you know that’s almost always never the case. Some clients might pay after a couple of days, others will make you wait a month or even longer.

Many businesses pay contractors on what’s called a ‘Net-30’ basis. This means that they have a 30-day window following your invoice submission in which to send your check.

Other companies may even have Net-60 or Net-90 payment windows, giving them almost three months to send the money they owe you. This can make it extremely difficult to maintain a positive freelance cash flow.

Fortunately, if you’re attentive, these windows shouldn’t come as a surprise as clients will list them in their terms. When you start a new project, you should also have your own contract in place that breaks down your desired payment schedule.

At this stage, you can attempt to negotiate shorter payment windows. Clients may not be willing to budge any lower than Net-30. However, some freelancers have had success offering ‘discounts’ for quick payments.

You can also go the opposite route and add late payment fees to your contract. It all depends on the approach you want to take and what your relationship with each client is like.

4. Negotiate Upfront Payments for Large-Scale Projects

The more time a project will take, the more important it is you see at least part of the money before it’s finished. This is a quick way to reduce risk on your end and ensure the client is committed to following through.

However, this can sometimes be a tough sell for clients. If you’ve worked for someone in the past, negotiating an upfront percentage becomes simpler since they likely already trust the quality of your work.

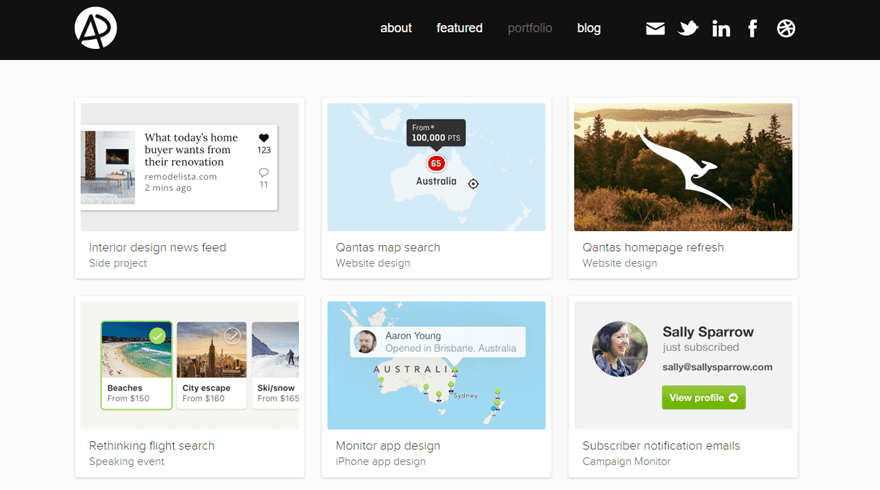

For new clients you don’t have relationships with, you need to show you know what you’re doing and that you’re reliable. The best way to paint yourself in a positive light from the get-go is with an excellent freelance portfolio:

Once you start negotiating with a potential new client, you need to assess the scope of the work they need from you. That will inform your decision of how high to set your rates and what percentage to ask for upfront. All this information should be part of your proposal.

In most cases, you and the client should agree on an upfront payment of between 20 and 50 percent of the final cost before setting it down in your contract. Showing a willingness to negotiate at this step can be vital to assuaging new lead’s doubts, so make sure you listen to what they need and explain how you will deliver.

5. Don’t Be Afraid to Take Out a Loan (With Favorable Terms)

It’s not uncommon at all for businesses to take out loans to cover expenses until clients pay up. This isn’t the same as running out of money because you didn’t budget. It’s just a matter of getting enough positive freelance cash flow, so you don’t have to stress about expenses while working on longer projects.

As we mentioned before, as a freelancer you need to think about yourself as a business. Taking out a loan isn’t something to do in desperation. However, if you have excellent credit and can secure a reasonable rate from your bank, this practice can help you stay afloat.

Many people fear debt, even though we use credit all the time during our day-to-day lives. The difference is that a loan will likely provide longer repayment terms, which works in your favor if you’re in the middle of a project that’s going to take a while to complete.

The average interest rate for a small-business loan is between 4-6 percent. You will take a slight loss while repaying the amount you borrow, so it’s not something you should rely on all the time. However, it can be an excellent way to give you some breathing room when needed.

Conclusion

As a freelancer, you have to take a more active role in managing your finances than most people do. You can’t always rely on timely paychecks, so you need to become better at budgeting and dealing with financial setbacks if you want to succeed.

Keep in mind these five tips to help you improve your freelance cash flow:

- Get serious about budgeting.

- Expand your client base.

- Avoid large payment windows when possible.

- Negotiate upfront payments for large-scale projects.

- Don’t be afraid to take out a loan (with favorable terms).

Do you have any questions about how to improve your freelance cash flow? Let’s talk about them in the comments section below!

Article thumbnail image by DRogatnev / shutterstock.com

This article is not only helpful for freelancers but also for small business as both are same in the starting stage.

Hi Kanan

Very pleased you found it useful, thanks for your comment 🙂

Hey Oliver, this is amazing content! I want to know the Linkedin is a good platform for searching the freelance project? Like it allows for the remote work process?

This is a great informative piece of content for the freelancers.

But I partially disagree with the 5th point which is taking loans. Taking big loans can put your whole career in danger.

Either way, Keep sharing this type of interesting articles. Thanks

Hi Oliver! Loans are indeed a tricky subject. I should’ve been clearer in that I only recommend business loans as a stopgap option if you’re working on projects that won’t pay for a while. If you’re in-between clients or in a dry spell, then taking a loan might be too risky – that’s what your rainy day fund should be for.

Mostly great advice, however I disagree with #3. As a business owners, you shouldn’t be letting customers dictate terms.

For one, in the U.S. it starts down the slippery slope of being categorized as an employee, not an independent contractor or service provider.

Two – It’s your business! Act like the owner! By all means be flexible when it is appropriate to do so, but only when appropriate. There is no “and *also* have your contract in place”. There’s one contract – an agreement between your business and your client. Not multiple. Not “your” contract and “theirs”.

Also missing, and what’s critical to many web designers is have progress payments – start with a non refundable setup charge, and then milestone(s) depending on the scope and scale of work.

Hi Elizabeth! You’re right about that, it’s important for freelancers to understand they’re running a business and how to be firm on their terms when needed. Upfront payments are also essential, particularly the larger the project is.

👍🏼

Good article.

The hardest part is to always have a steady cash-flow.

I liked the part about signing up for emails at upwork or indeed.

Very please you liked it and found it useful Andreas 🙂