Stripe is one of the most popular payment processors globally, but it’s particularly popular in the US. This platform helps process payments for almost two million websites. However, Stripe is not exempt from online fraud, which is a problem that plagues most online stores and payment processors. In 2019 alone, online fraud cost stores almost five billion dollars across the world.

There are plenty of ways to minimize instances of Stripe fraud in your WordPress store (or for any type of business you run). In this article, we’ll discuss what those methods are.

Let’s talk about how to prevent fraud!

What Are The Most Common Types of Stripe Fraud?

With most payment processors, payment fraud involves using credit cards or accounts that aren’t yours or requesting chargebacks. In the first scenario, users make purchases with stolen credit card numbers and try to ship products to locations they have access to.

Modern payment processors have a lot of ways to flag transactions as suspicious and help you detect fraud. However, sometimes fraudsters manage to slip by Stripe’s built-in security. Since you’re relying on Stripe to process payments for your WordPress website, that means that you may end up eating fees and processing costs for transactions that can be disputed.

Some customers will even dispute transactions that they made themselves, which is what we call a chargeback. In that scenario, the buyer will tell their credit card company or the payment processor that they didn’t make a purchase or that they never got their product.

Disputing chargebacks can be time-consuming, and it can cost you a lot of money and inventory. However, since you’re using Stripe, there are several ways you can protect yourself against all of these types of fraud.

Stripe Fraud: How to Protect Your Online Business (3 Ways)

Major payment processors such as Stripe already offer some basic fraud protection out of the box. However, if you want to minimize Stripe fraud as much as possible, we recommend that you take three additional steps.

1. Ask For More Customer Information

Optimizing the checkout process can be complicated. In theory, you want to make checkouts as simple as streamlined as possible, which often means asking for as little information as you can. However, if you only ask for basic credit card information, you open yourself up to the potential for increased fraudulent activity.

If many of your customers are using Stripe, you can customize the checkout process and ask them for the following information:

- Full billing address

- Postal code

- Shipping address (if you’re selling physical products)

Payment processors such as Stripe can help you flag transactions with discrepancies between the payment method and the customer’s personal information. For example, if a customer’s billing and shipping addresses are different, it may be due to someone using a stolen credit card.

The more customer information you collect, the easier it will be to spot fraudulent transactions. However, depending on how many sales you make, monitoring transactions manually might not be all that efficient. That’s where our next tip comes in handy.

2. Use Stripe’s Built-In Fraud Detection Tools

It’s easy to start using Stripe in WordPress. There are several great Stripe plugins that enable you to use this payment processor for your store. If you use WooCommerce, it’s one of the payment methods that the plugin suggests out of the box.

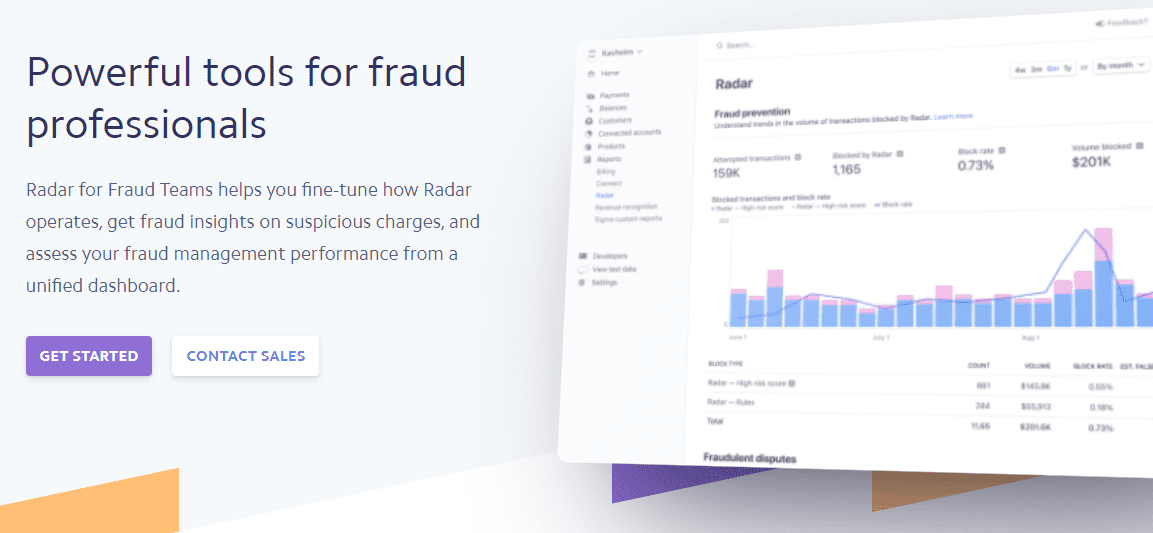

However, basic Stripe accounts don’t get access to the payment processor’s advanced fraud detection tools. Stripe offers a service called Radar, which can help you configure what level of “risk” you’re comfortable with when it comes to payments:

Radar automatically assigns a “risk” score to every payment, and you get to decide what threshold you’re comfortable with. For example, you can configure Radar to block payments with a risk score of 90 or higher.

You can also use Radar to set up complex payment blocking rules according to a broad range of criteria. You can block payments with IP addresses in specific countries, or prevent customers from re-trying to make purchases if their payments don’t go through.

Radar also enables you to set up lists of known “offenders” and store their IP addresses. That means if you get a user who tries to make a fraudulent purchase and Radar blocks it, you can save their IP address so they can’t try again with other accounts.

By default, Stripe charges you 2.9% plus a $0.30 fee for every transaction. If you choose to use Radar, you’ll need to pay an additional $0.70 per transaction. This can be a steep fee, but it’s worth it if Stripe fraud is causing you to lose money.

3. Secure Your Store Against Chargebacks

On top of fraudulent payments, chargebacks are one of the most common issues that online stores have to deal with. That’s when a user makes a purchase, they get the product, and then they try to dispute the payment. To do so, they’ll often claim that they didn’t get the product or that it was defective.

Often, payment processors will default to the customer’s side unless you can provide rock-solid evidence that you fulfilled your end of the deal. There are several ways you can protect yourself from chargebacks, including:

- Adding clear terms of service to your store. Terms of service can outline acceptable situations in which customers can dispute a purchase. If customers agree to the terms of service, you’ll get additional protection when dealing with fraudsters.

- Use carriers that provide online tracking and delivery confirmation. If you use shipping services that provide tracking details and require customers to sign for a purchase, you can prove that you delivered the products they paid for.

- Use Stripe’s Radar tool. Radar enables you to add chargeback protection for your store. You pay an extra fee for each sale, and Stripe deals with chargebacks if they occur.

Chargebacks are difficult to avoid altogether if you do business online. However, by taking the right steps you can minimize them so they don’t present a serious problem for your WordPress store. As a rule of thumb, you want to aim for a chargeback rate of less than 1% of all sales.

Conclusion

Stripe fraud isn’t more prevalent than with other payment processors. Regardless of what platform(s) you use, you’ll need to deal with fraudulent purchases and chargebacks. What you can do is take steps to minimize those instances as much as possible, so they don’t hit your bottom line too hard.

Here’s what you should do to protect yourself against fraud if you’re using Stripe:

- Ask for more customer information.

- Use Stripe’s built-in fraud detection tools.

- Secure your store against chargebacks.

We also know that it’s common to pair Stripe payments with other payment methods and online wallets such as PayPal (easily done with most payment plugins). If you use both Stripe and PayPal, you should take a look at our guide for protecting your business against PayPal fraud as well.

Do you have any questions about how to protect yourself against Stripe fraud? Let’s talk about them in the comments section below!

Featured Image via Jane Kelly / shutterstock.com

I hope it works out well for you!

Very helpful article, will look into Stripe.

This is interesting, as someone who uses Stripe almost daily in my business, I honestly never knew these things. I specifically liked the chargebacks thing that I never knew was an issue ( I don’t normally get a lot of chargebacks ) but this is very good to know

Thanks – I appreciate the kind feedback 🙂